Global Risks are at Unprecedented High Levels

The key reason for a global recession in near future is a continuing inflation. This inflation may rise for years like it did in 1970s. Its rise will be due to the unprecedented rise in money supply since the 2008 recession. Before the 1970s inflation, wars and other problems had forced U.S. government to increase money supply, which created inflation in 1970s. Now, just compare the two situations below –

- Since 1960 to 1970, money supply had increased at a CAGR of 3.94%, and inflation stayed above 5% for 10 years (1973 to 1982)

- Since 2008 to 2023, money supply increased at a CAGR of 25.2%, and inflation has just started rising!!

Compare 3.94% rise for 10 years with 25.2% for 15 years – it is devastating to think how long the inflation may last and how high it may go – it will be a complete destruction of global economy.

It is an unimaginable jump in money supply, never seen in the human history, it came in various forms – QE, QE1, QE2, QE3, ZIRP, bailouts, doles, backstops etc.

Data points to a massive recession

- Never assume recessions last 1-2 years, the 2008 recession lasted less than a year but it took six years for markets to recover to same levels

- In past 120 years history of stock markets, 66 years were spent in recessions and recoveries

- Current global inflation cannot be controlled for years to come as global economies are already weak and any increase in interest rate will push them into recession

- Most of data here is about U.S., as it is going to be the centre of recession

- U.S. government networth is -29.9 trillion USD (yes, it is negative), unimaginable, but it is the world’s largest and so-called strongest economy?

- U.S. housing is a bigger bubble than 2008’s housing crisis

- U.S. Inflation remains near a 40-year high

- U.S. housing sector lost $2.3 trillion in 2022, most since 2008

- Total U.S. mortgage debt now double the 2006 peak

- A record 48% of retired Americans will outlive their savings

- 67% of retired Americans have unpaid credit card debt

- Us government pays 14.5% of its revenue for interest on debt, it may reach over 30% in next few years, after deducting defence and healthcare expenses, it will not have much left – it is moving towards a bankruptcy.

Recession is well on its way; it cannot be stopped. It may start from U.S. but will impact all countries just like what happened in 2008. Link to my eBook – Biggest Recession is Coming

Charts that show looming recession

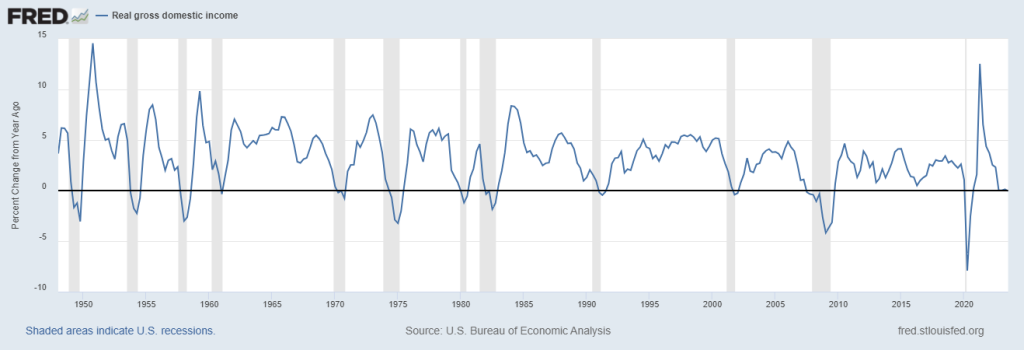

Real gross domestic income has now entered contraction

This has ONLY happened 12 times since 1948

Every instance occurred around a recession

Nearly half of US states are in a recession.

ONLY 20 US states are currently showing increasing economic activity

That has always ended in a recession since 1980.

Recessions don’t occur overnight with all states simultaneously entering recession. Weak states are the first to experience a recession. Once a certain threshold is reached, it becomes inevitable that other states will follow suit.

In the last 6 recessions, an average of 26 states were experiencing an economic contraction before the US entered a recession. Currently 22 US states are officially in an economic contraction. That’s almost half of America!

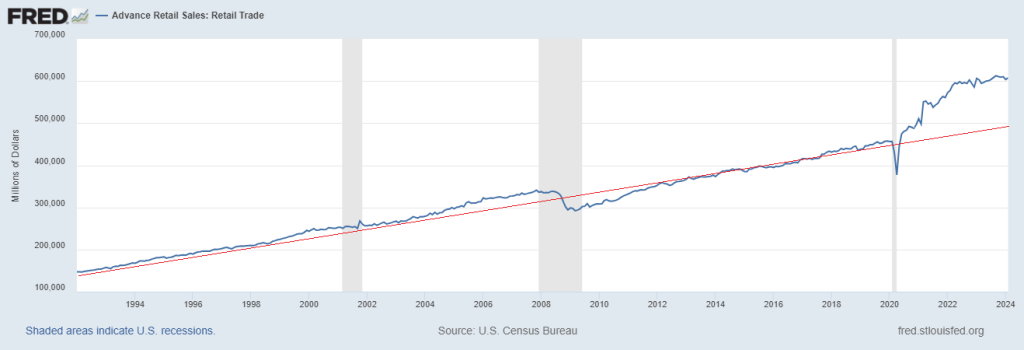

Super hot retail sales will cool down and that could result in a prolonged period of economic weakness.

In 2009, sales fell significantly below trend line during the recession (red line in chart below). Over the following years, sales rebounded as people made purchases they had postponed during the downturn. Post pandemic, people dramatically increased their purchases. But, they have likely fulfilled their purchasing needs now which should lead to a potential return of demand to the long-term trend. And that means a prolonged slowdown.

Stock concentration is now at Great Depression levels:

According to Goldman Sachs, the market cap of the largest stock is now 750 times the market cap of a 75th percentile stock. To put this in perspective, even at the peak of the 2000 Dot-com bubble, this number had only hit 550x. US now have a higher stock concentration than the peak of the Great Depression in 1932.

Every time industrial production dipped to current levels, it ended in a recession in the last 55+ years (except in 2015).

Money Market Funds have crossed a staggering $6 trillion figure.

Such steep rises were seen only during three major recessions since 1995:

- Dot Com Bubble

- Financial Crisis

- Pandemic

How long can it last?

Most investors have seen recessions lasting about one year (2008, 2020). It would be financially disastrous to assume that 1-2 years is the norm. This fabulous 100 years chart of US Dow Jones Index (Source: Chris Kacher, managing director of MoKa Investors) shows that recessions and recovery can last for very long period. During the first 100 years of this chart, US markets spent 60 years (19+25+16) in recession and recovery only! Although this chart is for US, but the stock markets move together all over the world. It is best to decide from case to case basis, one should not generalize.

What are the best methods for wealth creation during such a recession?

Hedge funds are a great options for such a scenario but not everyone can afford to invest in them. We offer a very attractive and simple solution using market-neutral index options. It needs a minimum fund of Rs 10 lakhs. If done correctly, these strategies can generate 2-6% per month (Indian markets). Click here to read more about this safe monthly returns plan.

You can find more investment options in this eBook – Biggest Recession is Coming.