Copper is the new lithium. A decade of low capex, trillions being spent on energy transition, China reopening, inventories at lowest levels of 18 years, not enough copper supply coming online in next few years – investing in copper is a slam dunk case.

Key Points

- South America dominates this red metal production and Chile is the largest producer. Increasing mining output has proved a challenge, creating a serious supply shortfall which can continue over the next decade.

- Beijing’s reopening is expected to quicken the country’s economic recovery, as well as pent-up Chinese demand for commodities.

- Demand is going to get a sustained boost from construction, electric vehicles, solar panels and other green technologies.

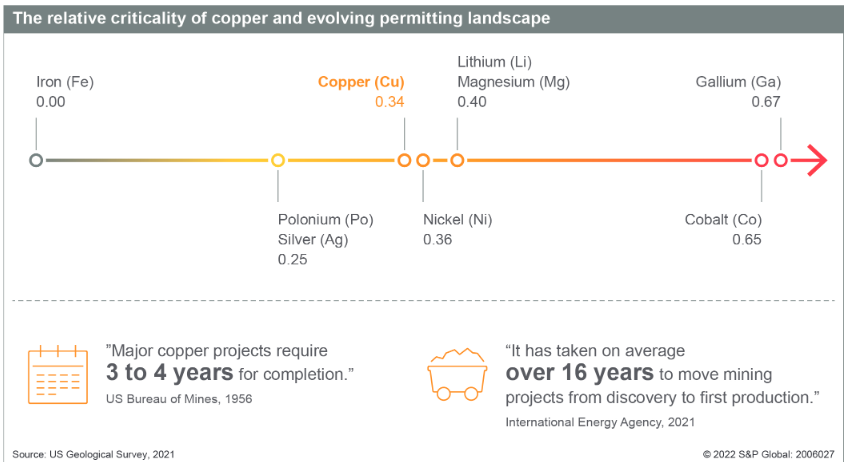

- New mine projects take 10-15 years to start production.

Copper faces critical supply shortages

It was the only metal with locked-in demand growth, but as per experts the prices need to rise by near 50% to attract investment in new mines.

Lack of new mine resources is the main hurdle.

Analysts forecast little output growth in Peru and Chile. Mines are operating at low staff levels and slowed operations after local protests from community groups.

Peru has been rocked by protests since former President Pedro Castillo was ousted in December in an impeachment trial. The South American nation accounts for 10% of the global copper supply.

Glencore announced on Jan. 20 it was suspending operations in its Antapaccay copper mine located in Peru, after protesters looted and set fire to its premises.

Additionally, Chile — the world’s largest copper producer which accounts for 27% of global supply — recorded a year-on-year decline of 7% in November and its production is at 6 years lowest level (Bloomberg).

Some projects are coming online in Peru and in Chile, which will add incremental supply, but there is not a lot in terms of pipeline in terms of long run. These new ores being mined are of lower grades, meaning that even if mining activity stays flat, copper volumes produced are likely to be lower.

Potential new supplies could come from the rich copper seams in Congo and Zambia in central Africa. They are now being exploited. However, the largest deposits are still in South America. According to Congo’s Ministry of Mines, red metal exports totaled 2.3 million metric tons in 2022, up from 1.8 million metric tons in 2021, less than half of Chile’s output.

According to Goldman Sachs in a note dated Jan 16, Chile will likely produce less copper from 2023 to 2025.

Copper Demand

In 2021, refined copper demand stood at 25.3 million tons, according to the International Copper Study Group. Electrification is expected to increase annual demand to 36.6 million metric tons by 2031, with supply forecast to be around 30.1 million tons, creating a 6.5 million ton shortfall at the start of the next decade, according to consulting firm McKinsey & Co.

Report mentions that the electrification phenomenon will likely be a bigger fundamental driver for demand. Electric vehicles cannot take off before you get the charging infrastructure, and the electrification is much more copper intensive.

This red metal features heavily in electricity-related technologies, and by extension energy transition proposals.

Sales of electric cars in 2021 more than doubled to bring the total number of EVs in the world around 16.5 million, according to the International Energy Agency. That means the EV-charging ecosystem will have to be ramped up.

Green uses accounted for 4% of copper consumption in 2020, but this is expected to rise to 17% by 2030, according to Goldman Sachs. It mentions “net-zero emissions” path would mean the world would need an additional 54% of copper by 2030 on top of that forecast.

“An electric vehicle (“EV”) requires 3½ times as much copper as an internal combustion engine vehicle [Wood Mackenzie].” Buses “require approximately 11 times as much.” (Forbes)

“Grid infrastructure necessary to support the expected number of charging stations in 2030 is expected to consume 250 percent more copper than the decade prior.” (Forbes)

Copper story in graphs

Future projected refined copper usage by source. Note that the green bar is just the non-energy-transition related spending and would have occurred no matter what. (S&P Global)

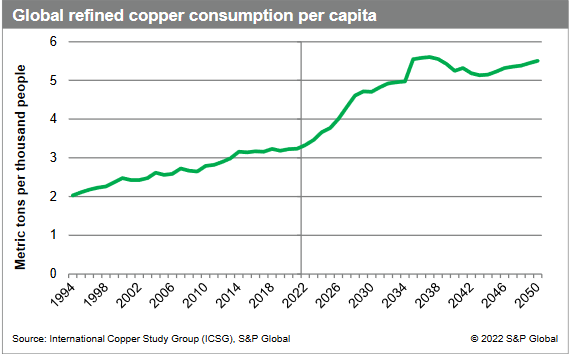

Consumption per capita and future projections (S&P Global)

Bringing mines online is an arduous process (S&P Global)

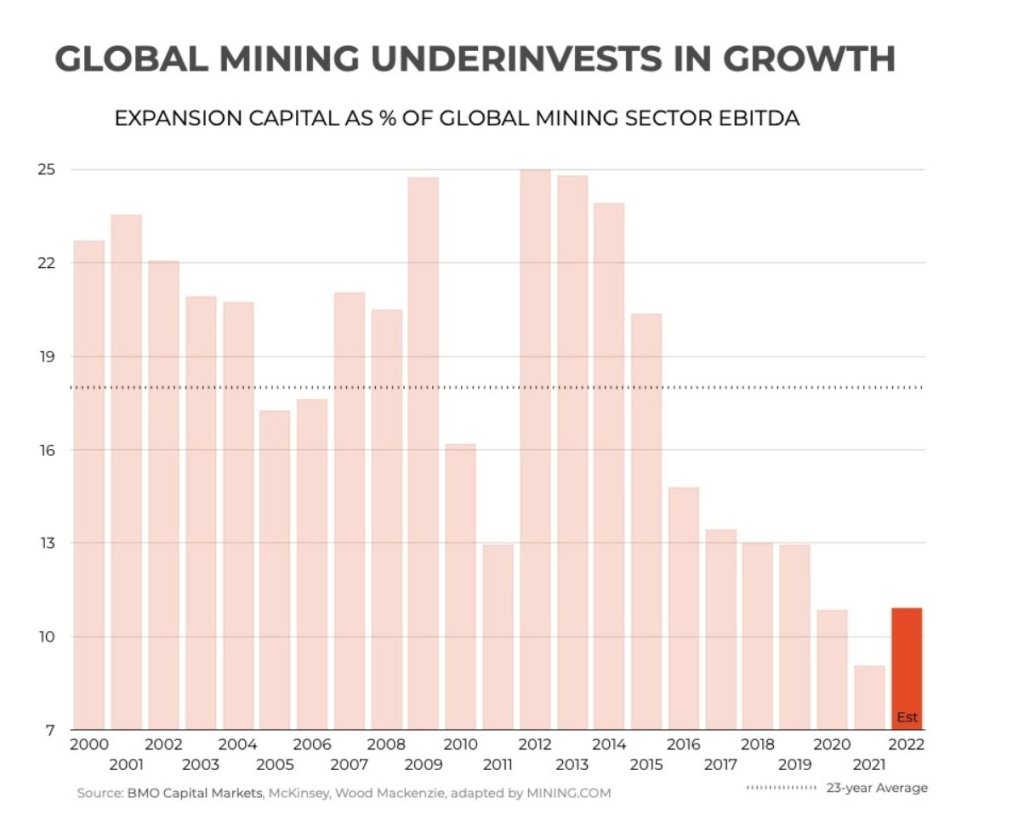

Low capex will create supply shortages.

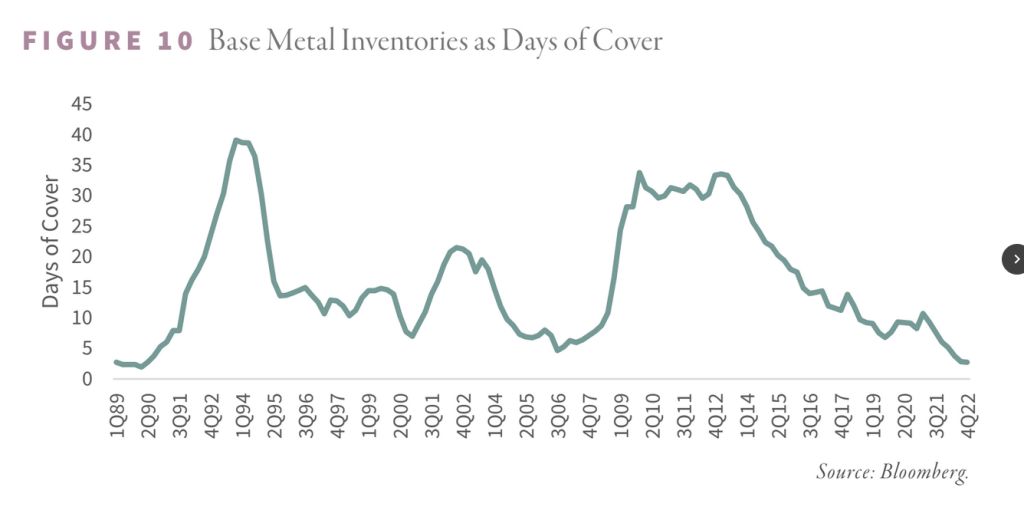

Record low base metal inventories, including copper. (Goehring & Rozencwajg)

Metals needed for net-zero plans (Bloomberg)

Fewer mining discoveries are being made

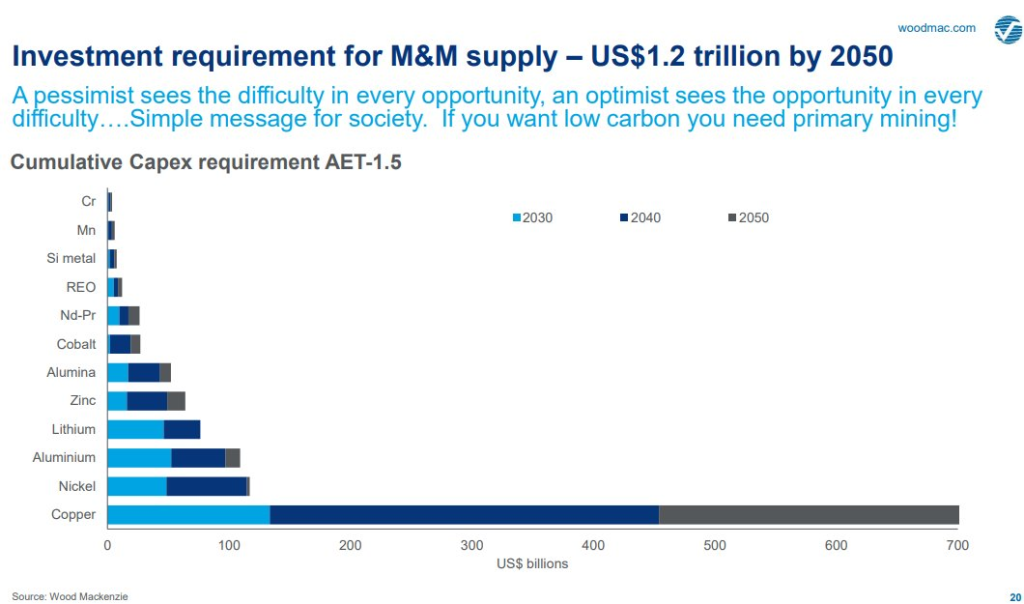

Future Capex requirements broken down by decade

Conclusion

Copper prices have been declining in 2023 but that may end soon. It may enter a bull market lasting for next few years. Downside is limited.

How will you invest – mining company stocks, copper ETF, or physical copper?