Subprime loans were the root cause of 2008 financial crisis, it started in U.S. but the impact was severely felt in all the countries across the globe. Another crisis is now brewing in U.S. in commercial real estate and again it will affect the whole world.

Key points –

- Many CRE (commercial real estate) owners took loans when rates were near zero

- They now have to repay when rates have more than doubled

- CRE owners also face the problem of rising vacancy rate because of work-from-home trend

- Banking crisis has forced banks to tighten credit, so refinance will be tough for CRE

CRE owners are in a seriously bad situation, they borrowed at very low rates, now have to pay at very high rates, occupancy rates are declining, and banks are not giving refinance loans easily. In next five years, more than $2.5 trillion loan will mature, which is more than any five year period in history. It is a confirmed case of crisis.

Multiple attacks on CRE

The U.S. Fed has raised interest rates to 5% currently from almost zero 12 months ago – the steepest jump in US rates since the 1980s.

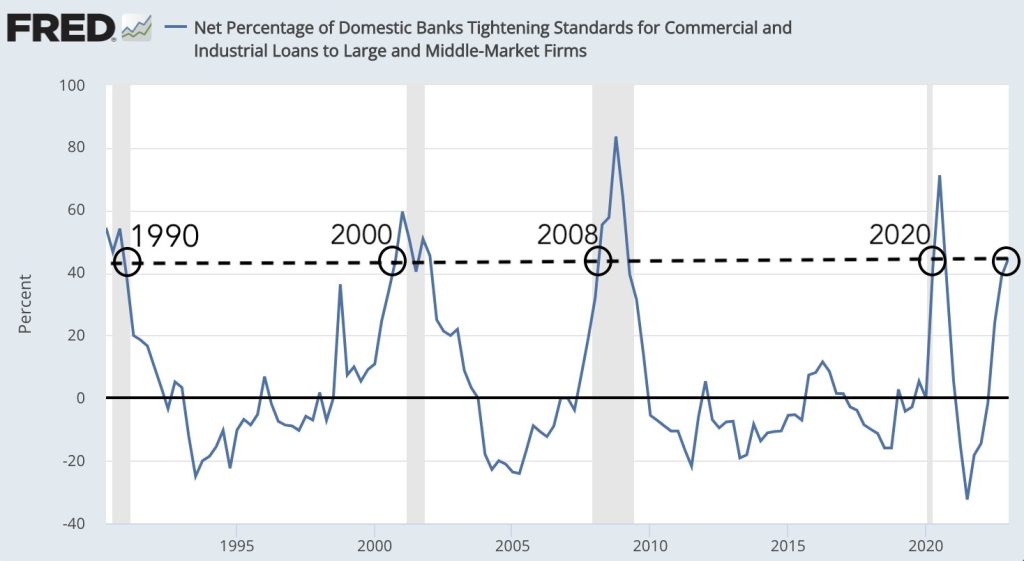

High borrowing costs plus tighter credit conditions caused by the banking crisis could raise hurdles for CRE owners to refinance loans. Nearly $450 billion in CRE debt is due to mature in 2023 – meaning a final payment on those loans are due, per data cited from Trepp. CRE owners will need funds, and banks are not giving credit easily, such high level of tightening always has led to recessions in the past as shown in chart below –

Regional banks are already stressed which reduces their ability to amend and consent to loan modifications given the pressure on the liability side of the balance sheet.

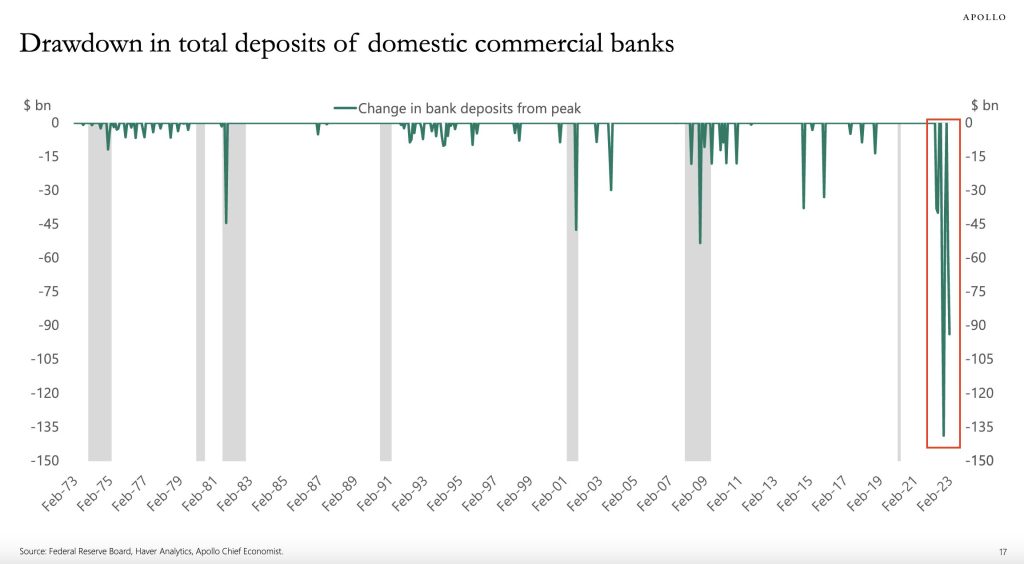

Bank deposits are depleting at an abnormally fast level and banks will find it extremely difficult to refinance CRE loans.

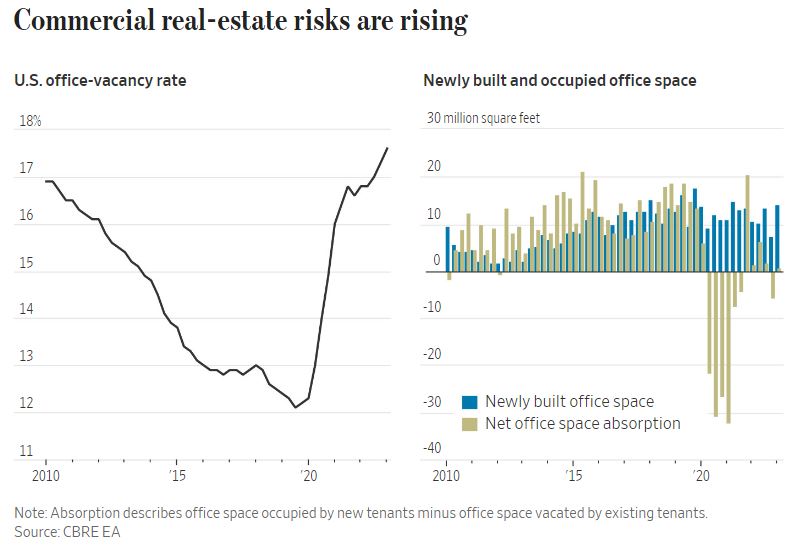

What is worsening this situation is the fact that occupancy rates are still far from pre-pandemic levels thanks to remote work trends. Against this backdrop, odds are rising that CRE owners could default on their debt.

If they default, it could be the perfect storm for the already battered US regional banks, given their large loan exposure to the sector. Such lenders hold almost 70% of outstanding commercial property debt, according to BofA.

Commercial property prices could fall as much as 40% like the decline during the 2008 financial crisis according to Morgan Stanley analysts.

These problems can hurt not only the real estate industry, but also entire business communities related to it.

Office loan is the worst segment in CRE, since 2021, 44% more by volume were in delinquency and 55% more were in special servicing, according to Trepp, a provider of data and insights on commercial real estate.

Recession is certain – Act now to protect your savings and investments

The current situation is a ticking bomb, if you wait for it to explode and then start worrying about your savings and investment, that would be too late – act now and read our eBook – “Biggest Recession is Coming – Proven methods to make money during these tough times”, available on Amazon at – https://www.amazon.in/Biggest-Recession-Coming-methods-algorithm-ebook/dp/B0BZ8LJM4V

You may also contact us for personalized solutions – info@trikaalcapital.com.