The world’s largest economy is giving clear indications of a global recession, yet stocks are in a rally. Let us first look at some factual indicators before deciding which one is more real –

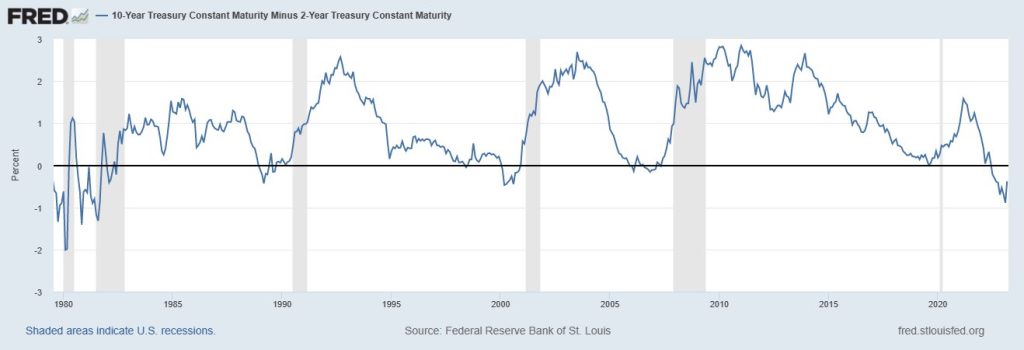

Inverted Yield Curve.

Historically, an inverted yield curve has been viewed as an indicator of a pending global recession. When short-term interest rates exceed long-term rates, market sentiment suggests that the long-term outlook is poor and that the yields offered by long-term fixed income will continue to fall. The current inversion is clearly indicating that a recession is coming.

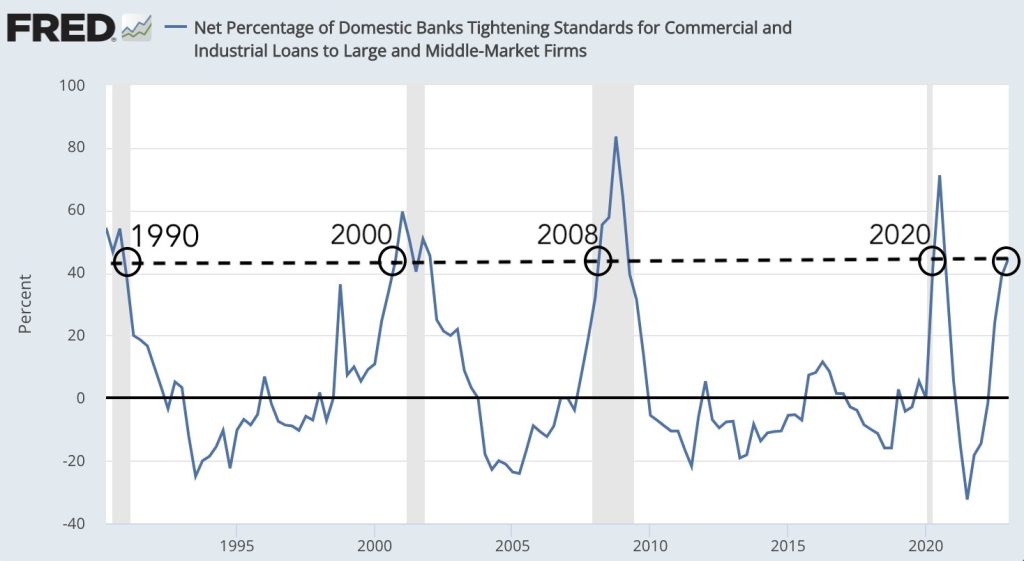

Bank Tightening at Recession Level

Tightening by banks have always led to recessions in past, the current situation is very clearly near recession levels.

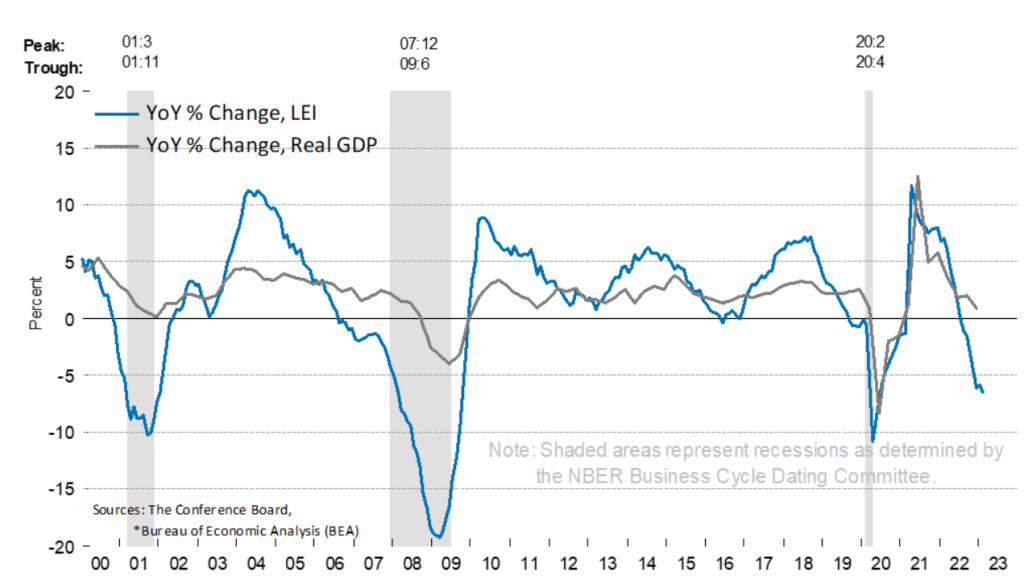

Conference Board Leading Economic Indicator

The Conference board LEI in blue line below has gone below -5, a level that has indicated global recessions.

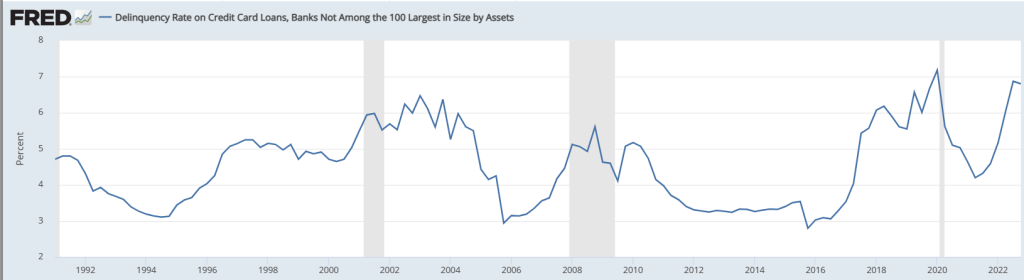

Delinquency Rate on Credit Cards

This indicator rises when people are not able to repay credit card debt on time. It had been increasing sharply before the past recessions, and the same is happening now also.

Rise in Borrowings by Commercial Banks

The recent banking crisis has forced all commercial banks to go for heavy borrowing. Historically it has always coincided with recessions.

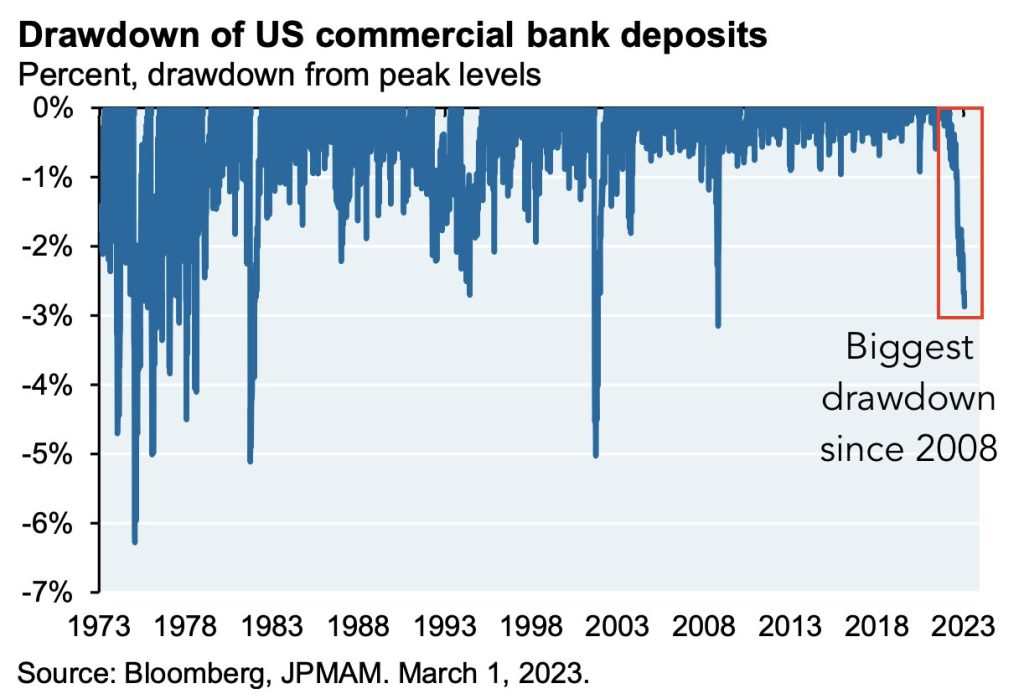

Spike in Bank Deposit Withdrawl

Recent U.S. banking crisis has caused massive bank drawdown. People are scared of safety of bank deposits.

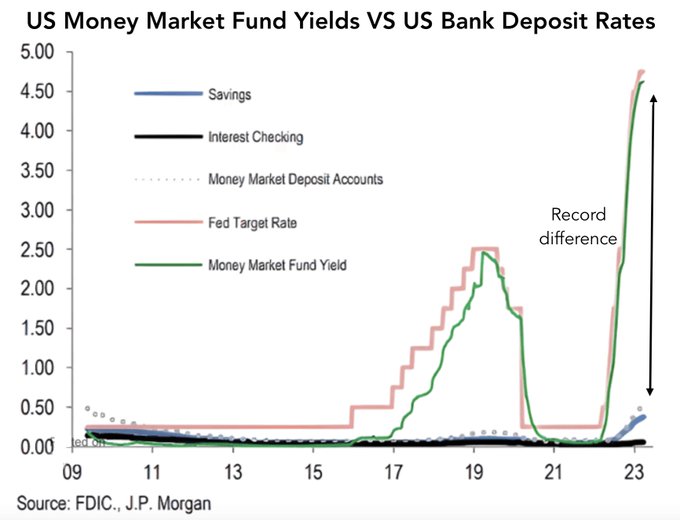

Bank Drawdowns will Rise More

As shown in chart below, money markets are offering nearly 4% more than banks, who will put money in a bank? And banks cannot give higher interest rates on deposits, because they invested in treasuries when rates were near zero. If they hike rates, they incur loss, and if they do not hike rates, they lose deposits. To refund deposits, they have to sell their treasuries at a big loss (the cause of current banking crisis). It is a situation with no solution. Banking crisis will come back. Read more in a previous post – “Second Largest Bank Failure in US – Contagion Crisis Looming”.

“

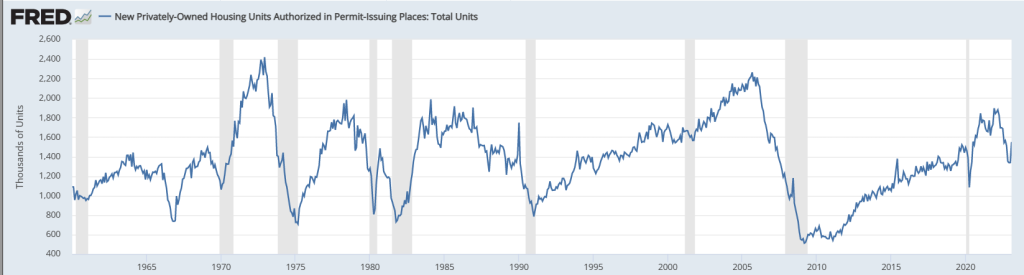

New Privately Owned Housing

Private new housing falls sharply before a recession, and it is doing that now.

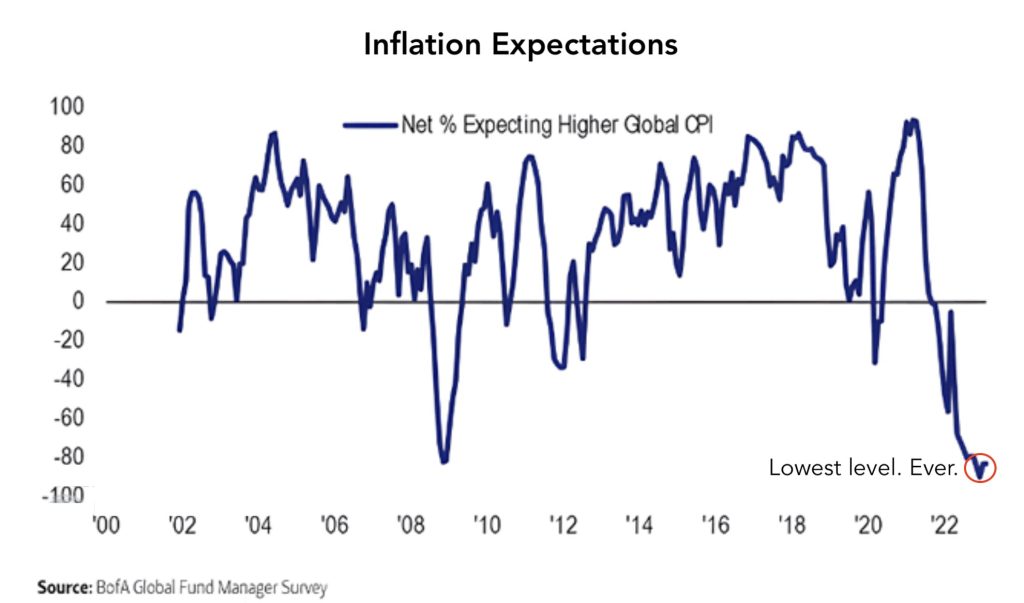

Why Stocks are Rallying?

Investors have become addicted to easy money post 2008 recession. Any indication that Fed will stop hiking the rates or will restart QE leads to a rally now. The chart below shows that most fund managers still think that inflation is going to decline. That is a very dangerous belief, and they will suffer a lot just like the banks are suffering now (Read a related article – “The Inflation Supercycle”). Since there is a mild decline in inflation so the stocks are rallying, hoping for a Fed pivot. It is a bull trap. In most of the recessions in past, there have a bear market rally, and these rallies can be quite sharp.